Art and Finance

Art Market | In the course of globalization and the influx of liquidity supplied by the countries with high growth, increasingly numerous signs of « financialisation » have appeared on the international art market. Backed by the government of Luxemburg, Deloitte Bank has set up a specialized pole working on the emergence of a veritable « Industry of Art and Finance ».

Art Market | In the course of globalization and the influx of liquidity supplied by the countries with high growth, increasingly numerous signs of « financialisation » have appeared on the international art market. Backed by the government of Luxemburg, Deloitte Bank has set up a specialized pole working on the emergence of a veritable « Industry of Art and Finance ».

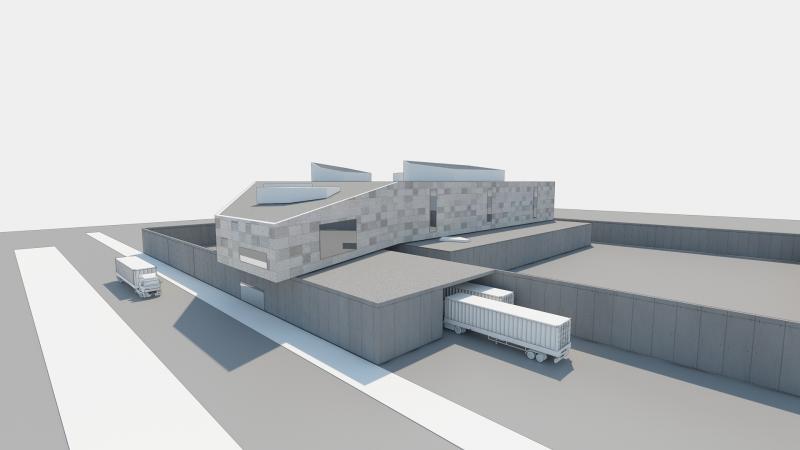

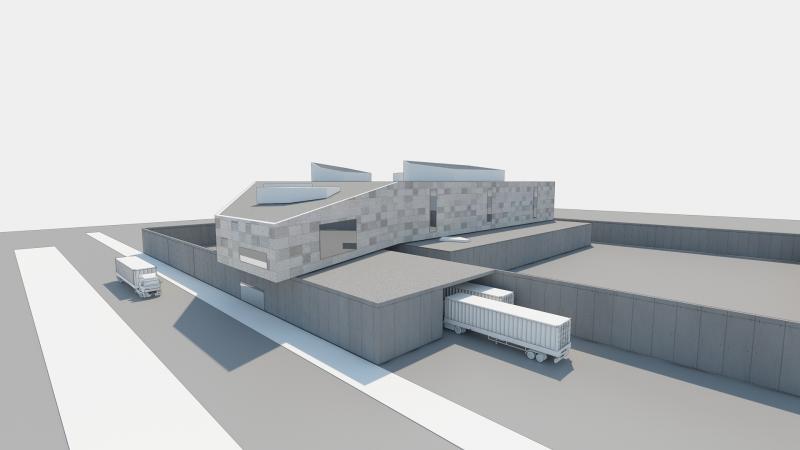

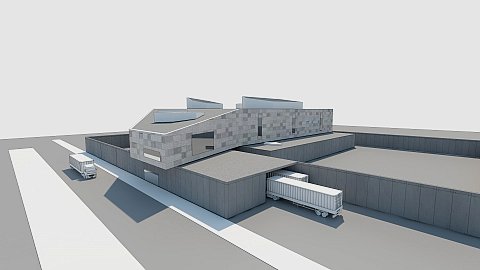

Projet du freeport pour l’aeroport du Luxembourg

Projet du freeport pour l’aeroport du Luxembourg

© Montant & Stendardo (3BM3)

The art market has radically transformed itself in recent years. The shifting of the centre of economic gravity towards Asia, the paths opened by the Internet and new technologies have structurally modified the techniques of art promotion, its evaluation, and transaction systems. In this world in mutation, « passion niches » like art and contemporary art are increasingly recognized by the world of finance as a diversification of investment alternative, a new class of assets able to serve as a shield against inflation. A market of investment funds is in the process of being created. Passion niches are redefining new criteria for the appreciation of art and constructing their purchasing policy on the basis of market confidence indicators which […]

You have 75% of the article to read ...

This article is free to read.

To continue reading it…

Subscribe

FREE

To our newsletter

Have you already subscribed to our newsletter?

Please enter your e-mail address